Dojium

Tokenomics

Discover the key elements of the Dojium token structure, designed to ensure transparency, stability, and growth potential.

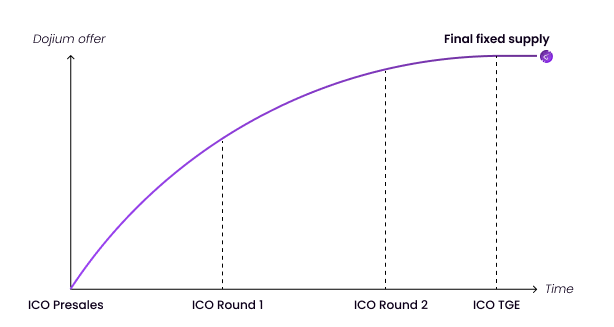

I. Fixed Supply

The number of tokens is fixed from the ICO, with no new tokens created afterwards, which stabilises the price and strengthens investor confidence for long-term growth.

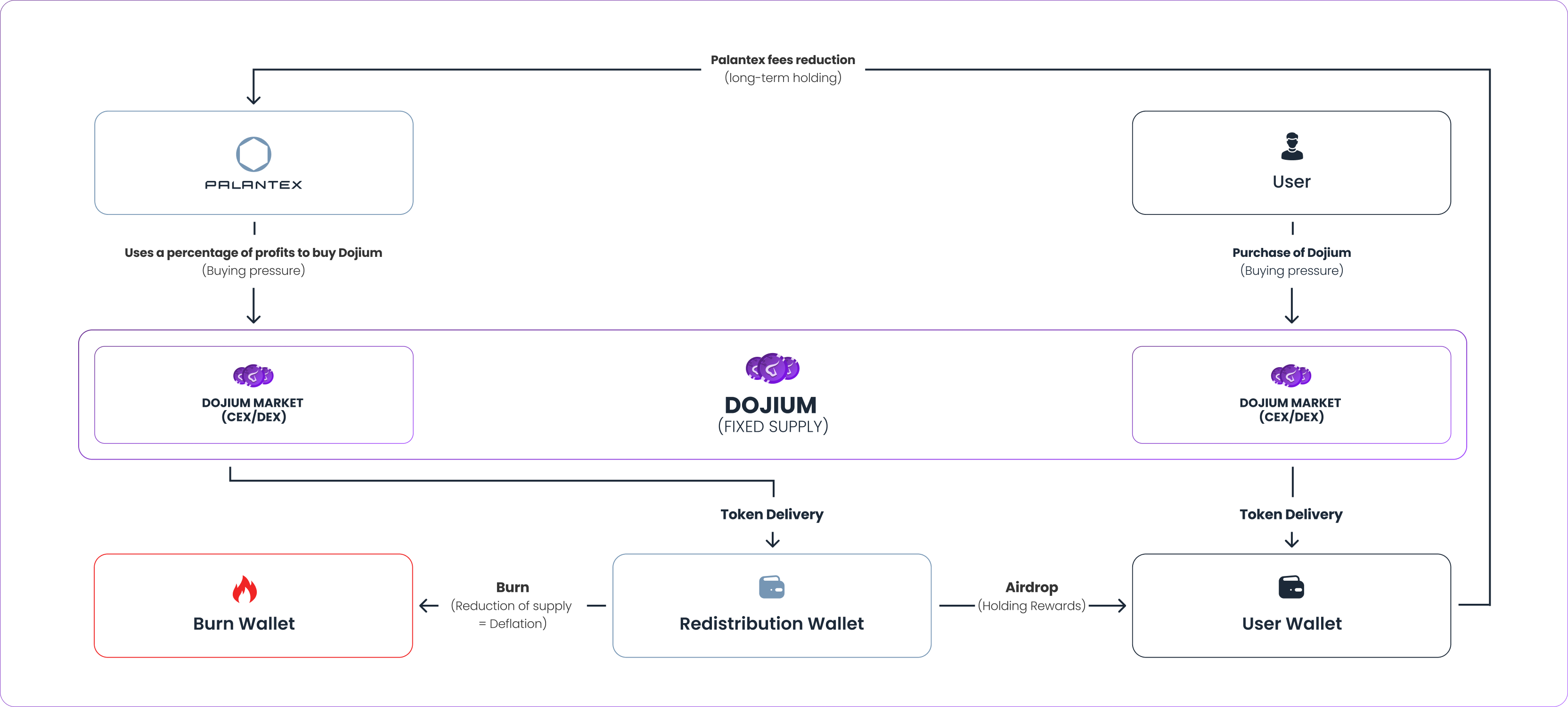

II. Buyback and burn of Dojium

The buyback and burn reduce the supply of tokens to increase their scarcity and value.

Uses a % of profits to buy back Dojium

III. Buyback and redistribution of Dojium

The buyback and redistribution of Dojium allows Palantex to repurchase Dojium to redistribute them to investors, reducing liquidity and stabilising the token's value.

Uses a % of profits to buy back Dojium

Airdrop for Dojium investors

IV. Encouragement to purchase

Palantex offer attractive benefits for purchasing Dojium, creating strong demand and limiting token sales.

Quarterly airdrop

Governance

Long-term investment

Reduction on fees

The virtuous circle of Dojium token holders

Discover how Dojium circulate in the ecosystem to optimise your investment.

Invest in our Dojium token

Seize the opportunity to invest now before prices rise, and enjoy your immediate benefits

Get Dojium